LiveEx-Shield

According to the FATF research, money launderers and terrorism financiers are increasingly using complex commercial arrangements to hide their money trails. Lawyers, accountants, and company secretaries are often involved in these arrangements. FATF standards require countries to improve their Anti-Money Laundering and Counter Financing of Terrorism (AML/CFT) measures related to DNFBPs based on these typologies. “DNFBP” stands for Designated Non-Financial Businesses and Professions. The FATF uses this term to refer to any business or profession that poses a money laundering risk, but cannot be classified as a financial institution. This sector poses risks due to the potential misuse of ML/TF. The LiveEx-Shield transaction monitor software is an integral part of the AML (Anti-Money Laundering) process, and it is an integral component of the AML ecosystem. Listed below are some of the reasons why the LiveEx-Shield TMS is a significant product and contributes to the implementation of the most effective AML practices in the industry.

Automating Compliance Processes

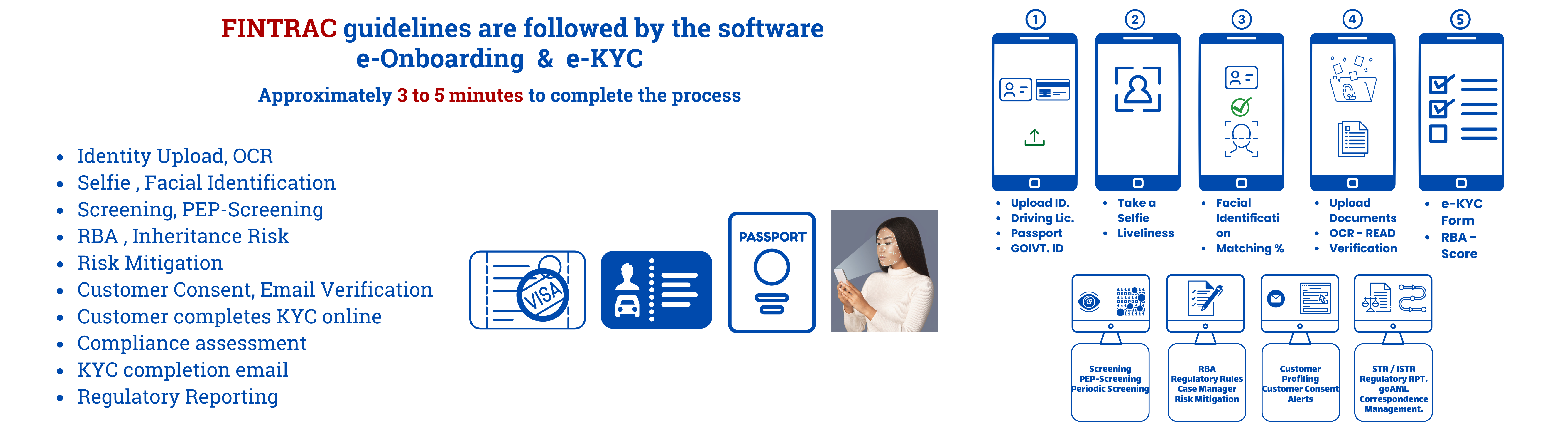

Many of the compliance processes required by regulators can be automated using LiveEx-Shield TMS, including identifying and verifying customer identities, screening customers against sanction lists, monitoring transactions, and producing reports. The automation of compliance processes reduces the risk of human error and ensures a consistent and efficient performance of the compliance processes.

Identifying Suspicious Activity

LiveEx-Shield TMS analyzes transactions in real-time in order to quickly identify potentially suspicious transactions using a combination of algorithms . This can include odd patterns of transactions, transactions that exceed certain thresholds, or transactions involving high-risk customers that have unusual transaction patterns. In the process of detecting suspicious activities, the LiveEx-Shield TMS is able to prevent money laundering and other financial crimes from occurring.

Improving Operational Efficiency

With LiveEx-Shield’s TMS, compliance processes can be streamlined and the amount of time spent on manual entry can be reduced, which in turn leads to a reduction in operational costs. A compliance team that is able to focus on high value-added activities such as investigations as well as reduce costs and improve operational efficiency as a result of this can help to reduce costs and improve operational efficiency.

Meeting Regulatory Requirements

LiveEx-Shield’s TMS is designed to help organizations comply with the regulatory requirements related to anti-money laundering and counter-terrorist financing by helping them comply with the regulatory requirements relating to these areas. By automating many of the compliance processes and enabling extensive reporting capabilities, it is believed that the LiveEx-Shield TMS can assist organizations in demonstrating to regulators that they are taking their compliance obligations seriously by helping them.

Anti Money Laundering Software & Services

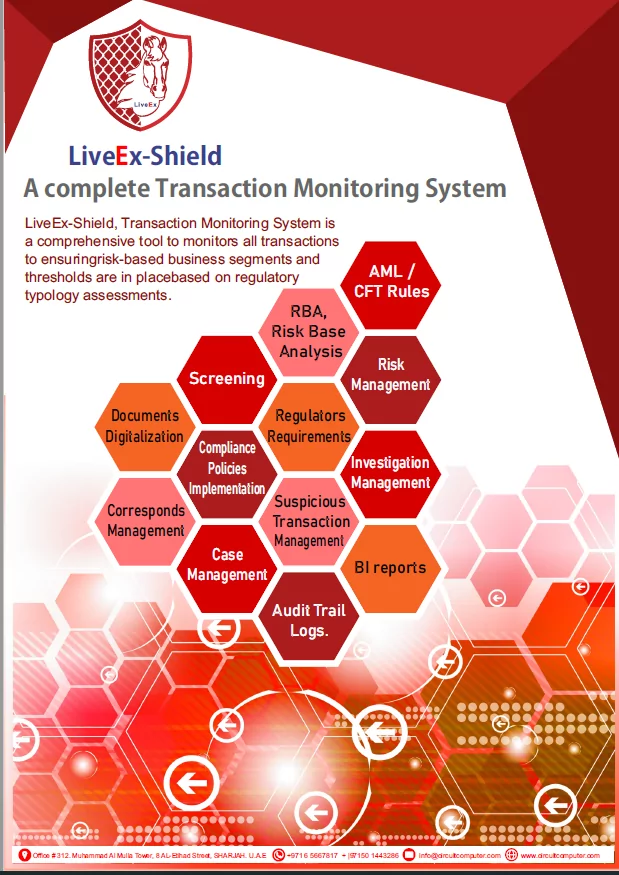

TRANSACTION MONITORING

Transaction Monitoring System is a comprehensive tool to monitors all transactions

SANCTION SCREENING

Sanction screening is a very important tool in the fight against ML/TF

RISK BASED APPROACH

The risk-based approach (RBA) is central to the effective implementation

DNFBPs COMPLIANCE

The FATF research highlighted a trend in the use of complex commercial arrangements

REGULATORY REPORTING

goAML is a fully integrated software developed by the United Nations Office on Drugs and Crime (UNODC)

AML/CFT TRANSACTION BEHAVIOR

The increasing number of AML/CFT cases and scenarios indicates traditional compliance approach

Be honest with your customers and don't keep them waiting

Fraud prevention, KYC compliance, and identity and age verification are all offered by LivExShield.com.

If you need a verification partner, LiveEx-Shield is the right choice

Establish trust, verify customers, comply with KYC, fight crime, and work globally Besides preventing fraud.

LiveEx-Shield ensures KYC compliance and ensures age and identity verification, as well as increasing conversion rates.

Identify and stop fraudsters

With our extensive fraud prevention and anti-money laundering services, including network analysis, automated ID review, and biometric extraction, you can welcome more honest customers and lock out fraudsters.

User-friendly interface

It shouldn’t be a barrier for sign-ups to require document verification. You can identify your customer . using a selfie and an ID photo They can take flawless shots every time since they have Assisted Image Capture as their personal automated photography coach.

Verification that is extremely accurate

By combining machine learning and artificial intelligence, we are able to perform document authentication and electronic age verification consistently well.

What Are DNFBPs and Why Should You Care?

Financial establishments likewise have some regulations to combat Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) and these businesses must adhere to the regulations. The avoidance of money laundering activities not only applies to financial organizations functioning as banks but still issued some guidance on FATF Designated Non-Financial Businesses and Professions (DNFBP).

Obligations of Designated Non-Financial Business and Professions

As per the DNFBPs guidelines, DNFBPs must develop effective AML/CFT policies, practices, controls, and procedures to spot suspicious transactions and report them to prevent money laundering activities

What kind of Business falls into the DNFBP category

- Auditors, external accountants, and tax advisors

- Casinos and other gambling service providers

- Company service providers

- Dealers in precious metals

- Dealers in precious stones

- Lawyers

- Notaries and other independent legal professionals

- Real estate agents

- Trusts

Real Time Business Solution

Circuit Computer provide real time business solutions which may help to streamline the DNFBPs business processes. Circuit Computer focus on the needs of customers and designed the LiveEx DNFBPs solutions as per the FATF recommendations.

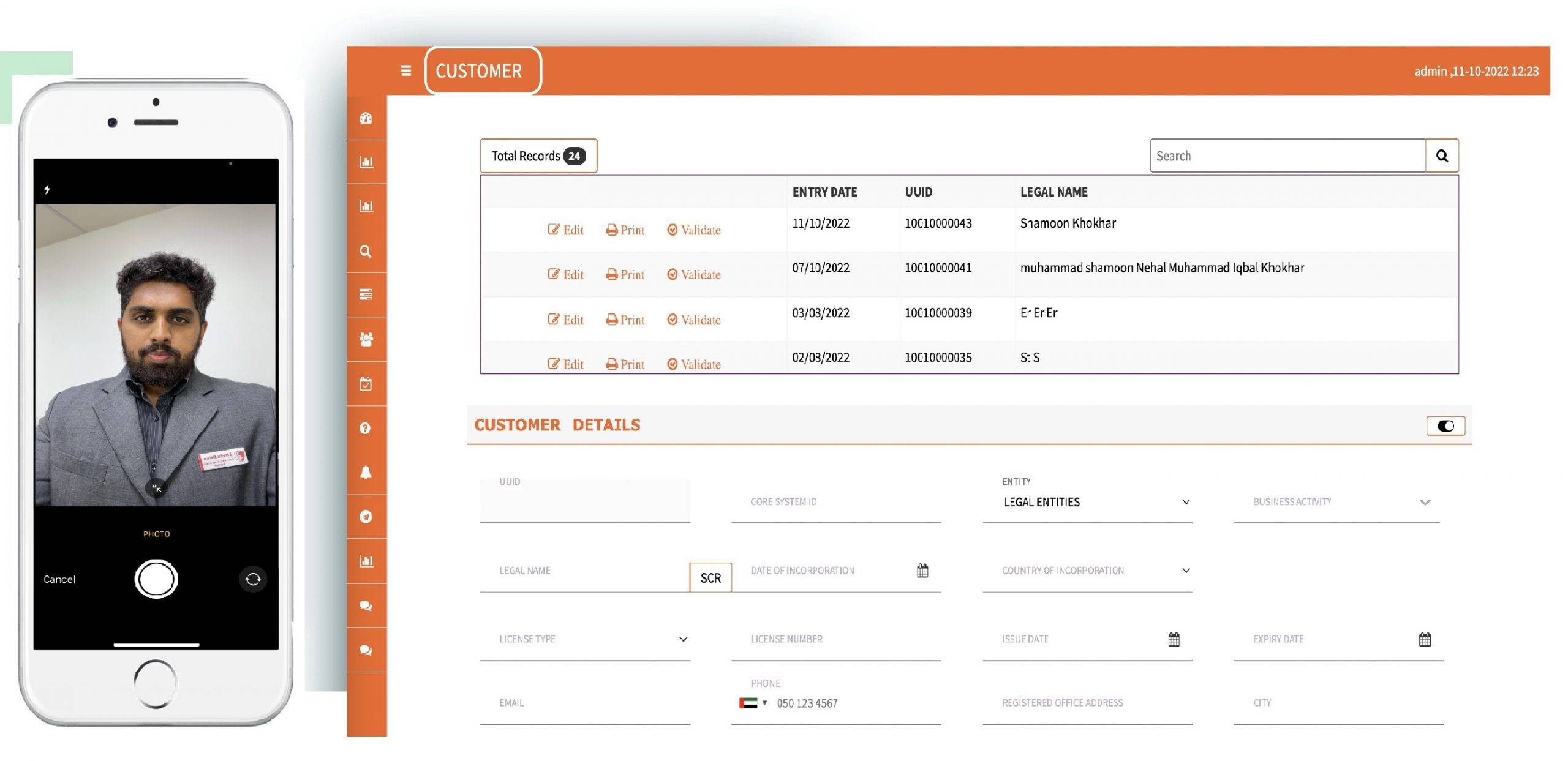

The LiveEx-Shield system provides comprehensive dashboard after the successful login for quick analysis. Live EX provides real time business solutions which may help to streamline the DNFBPs business processes. Circuit Computer focuses on the needs of customers and designed the LiveEx DNFBPs solutions as per the FATF recommendations, Central bank, Ministry of Economy, FIU and other international standards.

Chapter 16 of the Standards for the Regulations Regarding Licensing and Monitoring of Exchange Business, Version 1.20 of November 2021 amending Version 1.10 of February 2018 (Central Bank)

Download the Anti-Money Laundering Guidelines for Designated Non-Financial Entities and Industries (DNFBPs) issued by the United Arab Emirates Ministry of Economy (MOE).

downloand

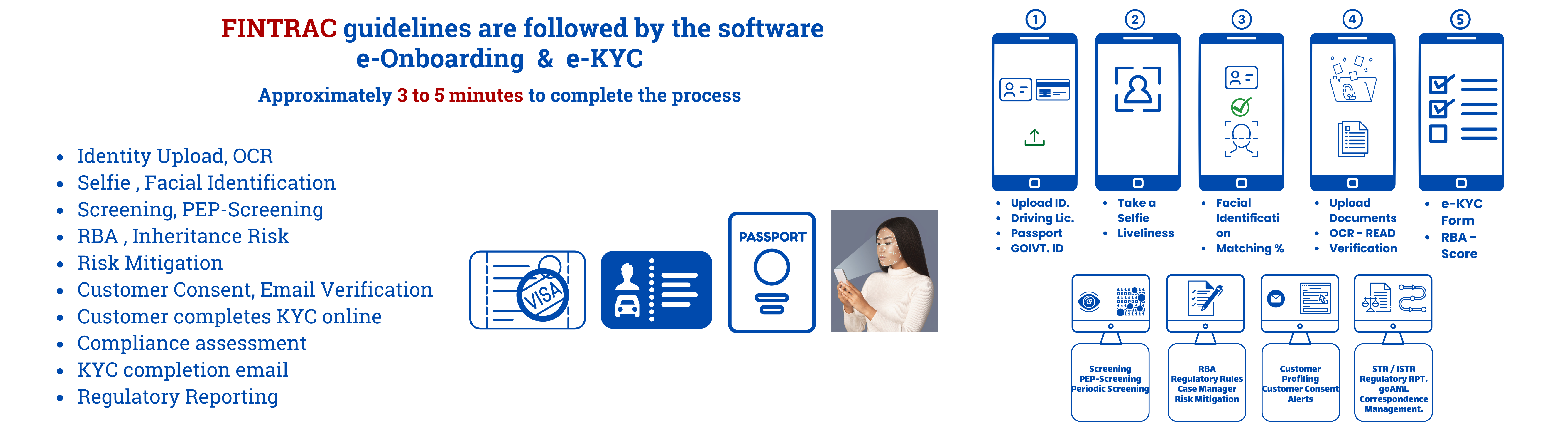

FINTRAC - Government of Canda.

Compliance program requirements issued guideance came into effective on June 1, 2021. The compliance program requirements under the Proceeds of Crime (Money and Terrorist Financing Act (PCMLTFA) and associated Regulations apply to all reporting entities (REs)

(i) FINTRAC – Complinace program guidance

(ii) FINTRAC – Risk assessment guidance

Regulatory - Standards

16.14.1 EDD is required before entering into any business relationship with, or processing any transactions for, DNFBPs as defined under the AML-CFT Decision. DNFBPs may be natural or legal persons. 16.14.2 The Licensed Person must implement appropriate, procedures, systems and tools to determine whether a customer is a DNFBP. 16.14.3 Where a customer is determined to be a DNFBP, the Licensed Person must carry out the following required steps, in addition to the CDD and EDD required by Paragraph 16.11 of these Standards and any other EDD appropriate to manage the risk of the customer:

a) Verifying that the customer has the required licenses; b) Obtaining information sufficient to determine that the customer is compliant with the AML/CFT preventive measures required under AML-CFT Decision; c) Take additional steps to understand the customer’s business, including the products and services it offers, its geographic footprint, and its customer base; d) Obtain approval from the Compliance Officer and the Manager in Charge of the Licensed Person before establishing the business relationship or processing any transactions. Tipping-off and confidentiality Financial institutions, their directors, officers and employees should be: (a) protected by law from criminal and civil liability for breach of any restriction on disclosure of information imposed by contract or by any legislative, regulatory or administrative provision.

if they report their suspicions in good faith to the FIU, even if they did not know precisely what the underlying criminal activity was, and regardless of whether illegal activity actually occurred; and (b) prohibited by law from disclosing (“tipping-off”) the fact that a suspicious transaction report (STR) or related information is being filed with the FIU. These provisions are not intended to inhibit information sharing under Recommendation 18. The requirements set out in Recommendations 18 to 21 apply to all designated non-financial businesses and professions, subject to the following qualifications:

a) Lawyers, notaries, other independent legal professionals and accountants should be required to report suspicious transactions when, on behalf of or for a client, they engage in a financial transaction in relation to the activities described in paragraph (d) of Recommendation 22. Countries are strongly encouraged to extend the reporting requirement to the rest of the professional activities of accountants, including auditing. b) Dealers in precious metals and dealers in precious stones should be required to report suspicious transactions when they engage in any cash transaction with a customer equal to or above the applicable designated threshold. c) Trust and company service providers should be required to report suspicious transactions for a client when, on behalf of or for a client, they engage in a transaction in relation to the activities referred to in paragraph (e) of Recommendation 22.

1

Customer Onboarding

2

Transactions

3

Screening

4

Risk Base Approach

5

Rules

6

Case Management

1

Customer Onboarding

2

Transactions

3

Screening

4

Risk Base Approach

5

Rules

6

Case Management

1

Customer Onboarding

2

Transactions

3

Screening

4

Risk Base Approach

5

Rules

6

Case Management

LiveEx-Shield Controls & Effectiveness

Regulatory Controls

- Adopt an effective AML sanctions screening program in response to increasing regulatory pressure

- Ensure your operations are compliant with standardized compliance reports

- Customize reports and manage them

- A complete and reliable audit trail is accessible and exportable

- Comply with the requirements of auditors and regulators

Functional Effectiveness

- Validate and authenticate your customers’ IDs instantly for faster onboarding and service facilitation

- In order to drastically reduce the time and resources spent on inaccurate matches, reduce the number of false positives when screening customers

- Onboarding timelines and costs can be reduced

- Streamline your remediation workflow for efficient reporting

- Monitor screening processes constantly and automate them over time

- Integrate compliance processes into core applications, CRM, and ERP systems

LiveEx-Data Integrations with Associates ....

LiveEx-Data Integrations with Associates ....

LiveEx Shield Associated with CircuitComputer an Emerging Software Company

At CircuitComputer International, we are uniquely positioned to offer high quality services at competitive prices. Circuit Computer Software is close to major financial institutions, ensuring smooth business flow, reducing risk, cost, and management activities. The company not only has the latest technology gadgets but also the most knowledgeable and experienced staff to provide customized solutions that are user friendly. With proven experience, Circuit Computer International can establish dedicated teams to offer a range of services. As a highly motivated team, we aim to provide our customers with an innovative solution that exceeds their expectations and simultaneously influences and raises the communities in which we operate

Why Chose US ?

- Subject Matter Experts Team

- Easy to learn, intuitive approach

- Interactive input/out screens

Quick Implementation - 24 X 7 online assistance

- Cost effective solution

- A wide range of learning program

- GOVT. acknowledged ”Accredited Software Provider’

- Two decades experience of AML/CFT compliance software implementation

How Can Benefit You?

- Customized solutions with practical tactics

- Regulatory reporting management

- Auto Updates with regulatory frequent changes

- Ensures effectiveness of Compliance

- Real-time alert management

- FIT FOR PURPOSE software

- Controls & Digitalization of business compliance

LiveEx - Complete ERP Solution for Financial Institution

- Many Financial Institution are slowed down by software that provides lengthy front desk operations and irregular and undecipherable back desk ones

- With increasing regulatory pressures, complex global operations, rising demand for innovative customer service and new competitors entering the market, Currency Exchange Centres cannot afford to be bogged down by fossilised software.

- This is where Omit Computer International saw an opportunity for innovation

Services that we offer

Our services can add value to real time business solutions which may help to streamline business processes.

We focus on the needs of customers. depending on the needs and size of your organization, our solutions can be used to streamline your business-to-business (B2B) and business to customer (B2C) processes. Circuit Computer can identify the areas where you can leverage the Internet to make your organization run more smoothly.

AML/CFT Solutions

Customized Software

Mobile APP. (IOS/android)

Process Automation

Digitalization

EIS - Dashboards

LiveEx Shield Corp. is uniquely positioned to offer high quality services at competitive prices.

LiveEx Shield Corp. Software’s proximity to major Financial Institution to ensures that business flow smooth, significantly reducing the risk, cost, and management activities. It possesses not only the latest technology gadgets but also the most knowledgeable and experience hands to offer most user friendly customized solutions.

Clients Feedback

Very grateful I feel as though they gave a life long carrer and they have went above and beyond 4 me!!!

Alfred D

"Very polite and gave me a nice variety to pick from"

James D.

"Very professional, kind, helpful and very accommodating..."

Michael D.

As an organisation with sales into over 100 countries and a global footprint it’s imperative for us to have a business partner

Jeri Young

Our Brochures

LiveEx-ERP

A complete solution for financial institutions

LiveEx Shield

TMS, Transaction Monitoring System, AML/CFT compliance solution

RiskRegister

AFCBRA, RiskRegister, AML/CFT compliance solution

Touch&Done

HR & Performance Managment Solution

LTAS

Location Tracking & Attendance Solution

GOAML

LiveEx-Shield, TMS for DNFBPS

OUR Brochures

we Develop Software, we Implement Software, we Love Software

AML/CFT , Software Solution

LiveEx-Shield, AML/CFT

LiveEx Shield

TMS, Transaction Monitoring System, AML/CFT compliance solution.

RiskRegister

AFCBRA, RiskRegister, AML/CFT compliance solution.

Screening

LiveEx-Shield, Screening.

About Us

LiveEx-Shield, About Us, Contact Us

LiveEx Shield

LiveEx-Shield, TMS for DNFBPS.

Contact Us For Demo

Live Ex Shield Corp.

Anti Money Laundering, KYC, Risk and Compliance Software and mobile applications. Our clients : Real Estate, Law Firms, Jewelers, Consultants, Remittances, Forex Bureau and Banks.

Contant US

Phone: +1 (416) 684 6622

Address: 150 Consumers Road, Suite 502, North York ,ON, Canada M2J 1P9

Customer Success

Essentials © LiveEx Shield Corp. 2021